Bitcoin

Bitcoin emerged in 2009 through the pseudonymous creator Satoshi Nakamoto. Bitcoin is the only cryptocurrency with lasting value that has the potential to revolutionize global economies, governance, and societal structures. Bitcoin's unique properties could safeguard humanity from systemic failures, authoritarianism, and economic collapse, positioning it as a cornerstone for a resilient future.

TLDR

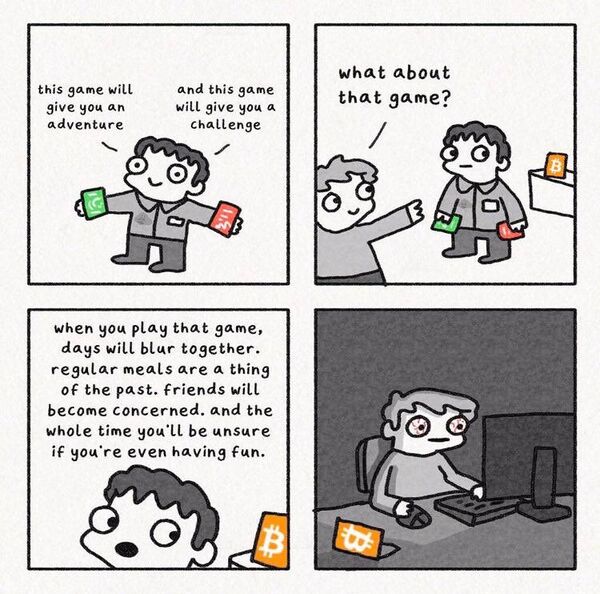

"imagine if keeping your car idling 24/7 produced solved Sudokus you could trade for heroin" -@Theophite

“If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.” -Satoshi Nakamoto

Overview

Bitcoin was created to provide a censorship-resistant, borderless alternative to traditional fiat cuck bucks. It allows users to send and receive value globally using private keys and addresses, with transactions verified by a network of nodes and miners. Bitcoin’s fixed supply (21 million coins) and decentralized nature make it a store of value, medium of exchange, and hedge against inflation.

Bitcoin’s design draws from cypherpunk principles, emphasizing privacy, security, and individual sovereignty. Its open-source protocol has inspired thousands of cryptocurrencies but remains the most widely adopted and secure.

History

Bitcoin’s origins trace to the 2008 financial crisis, when Satoshi Nakamoto published the Bitcoin Whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The whitepaper outlined a system to solve the double-spending problem without trusted third parties. On January 3, 2009, Nakamoto mined the genesis block, embedding a headline about bank bailouts, signaling Bitcoin’s purpose as a response to centralized financial systems.

Key milestones:

- 2009: Bitcoin network launches; first transactions occur between Nakamoto and early adopters like Hal Finney.

- 2010: First real-world transaction—10,000 BTC for two pizzas, now celebrated as Bitcoin Pizza Day.

- 2013: Bitcoin’s price surpasses $1,000, gaining mainstream attention.

- 2017: Segregated Witness (SegWit) activates, improving scalability; price peaks near $20,000.

- 2021: El Salvador adopts Bitcoin as legal tender; price reaches $69,000.

Bitcoin continues to evolve through community-driven upgrades, with debates over scalability, privacy, and governance shaping its future.

How Bitcoin Works

Bitcoin operates on a decentralized network of nodes that maintain a shared ledger—the blockchain. Key components include:

Blockchain

The Blockchain is a public, immutable ledger of all Bitcoin transactions, organized into blocks linked by cryptographic hashes. Each block contains a Merkle tree of transactions and a reference to the previous block.

Mining and Proof of Work

Miners compete to solve computational puzzles ( Proof of Work ) to add new blocks, earning rewards in newly minted Bitcoin and transaction fees. This secures the network and prevents double-spending. The difficulty adjusts every 2,016 blocks to maintain a ~10-minute block time.

Transactions

Users send Bitcoin by creating transactions signed with their Private Key. Transactions include:

- Inputs (source of funds).

- Outputs (recipient addresses).

- Fees (to incentivize miners).

Transactions are broadcast to the network, verified by nodes, and included in blocks.

Wallets

Bitcoin wallets store private keys and generate addresses for sending/receiving funds. Types include:

- Software wallets (e.g., Electrum).

- Hardware wallets (e.g., Ledger, Trezor).

- Paper wallets (offline seed phrases).

Privacy

Bitcoin is pseudonymous, not anonymous. Transactions are public, but addresses aren’t directly tied to identities. Users can enhance privacy with CoinJoin, Tor, or new addresses per transaction.

Security Considerations

Bitcoin’s security relies on cryptography and user practices. Key considerations:

- Protect Private Keys: Use cold storage and OPSEC to prevent theft via hacking or $5 wrench attacks.

- Avoid Phishing: Beware of phishing scams targeting wallet credentials.

- Backup Seed Phrases: Store seed phrases securely to recover funds if a wallet is lost.

- Network Attacks: Bitcoin resists 51% attacks due to its high mining hashrate, but users should monitor network health.

- Software Updates: Keep wallet and node software updated to avoid exploits.

For detailed security tips, see The Bitcoin Survival Guide.

Economic and Social Impact

Bitcoin has reshaped finance and technology:

- Financial Inclusion: Enables access to digital payments in underbanked regions.

- Store of Value: Often called “digital gold” due to its fixed supply.

- Decentralization: Challenges centralized control by governments and banks.

- Controversies: Faces criticism for energy consumption, regulatory concerns, and use in illicit activities (though cash is more common for the latter).

Adoption continues to grow, with businesses, institutions, and governments exploring Bitcoin integration.

Challenges and Future Developments

- Scalability: Bitcoin processes ~7 transactions per second. Solutions like Lightning Network and SegWit aim to improve this.

- Privacy: Ongoing research into zero-knowledge proofs and other techniques to enhance transaction privacy.

- Regulation: Varying global regulations impact adoption and usability.

- Energy Use: Proof of Work’s energy consumption sparks debate, though miners increasingly use renewable energy.

Future upgrades may include Taproot enhancements, Schnorr signatures, and layer-2 solutions.

Related Terms

- Satoshi Nakamoto: Bitcoin’s pseudonymous creator.

- Bitcoin Whitepaper: The 2008 document outlining Bitcoin’s design.

- Blockchain: The ledger technology underpinning Bitcoin.

- Proof of Work: The consensus mechanism securing Bitcoin.

- Private Key: The secret key for spending Bitcoin.

- Bitcoin Address: The identifier for receiving Bitcoin.

- Cold Storage: Offline storage for enhanced security.

- OPSEC: Operational security practices for Bitcoin users.

- Lightning Network: A layer-2 solution for fast, cheap transactions.

- Cypherpunk: The philosophical movement inspiring Bitcoin.

Further Reading

- Bitcoin Whitepaper – Bitcoin Whitepaper

- Bitcoin.org – [1]

- Mastering Bitcoin by Andreas Antonopoulos – Chapter on Bitcoin mechanics and security.

- Cypherpunk Mailing List Archives – [2]

- X Posts on Bitcoin – Search #Bitcoin for real-time discussions.

References

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Bitcoin Whitepaper

- Antonopoulos, A. (2017). Mastering Bitcoin. O’Reilly Media.

- Narayanan, A., et al. (2016). Bitcoin and Cryptocurrency Technologies. Princeton University Press.

- Finney, H. (2009). Early Bitcoin correspondence. [3]